[ad_1]

Appreciated by individuals for its attractive prices and its functionalities, the Revolut neobank is also full of advantages for businesses. Integrated invoicing and management tools, online collections, personal bank cards: everything is done to make the daily lives of professionals easier.

Businesses and independents do not necessarily have the neobank reflex. However, some organizations like Revolut have offers specially calibrated for this clientele and offer much more than basic banking services.

It is not for nothing that, created in 2015, Revolut has already convinced more than 20 million individuals and 500,000 professionals. Its secret: competitive prices with formulas adapted to each size of company, but also a range of integrated solutions to facilitate their daily management, collections and invoicing.

Offers designed for each type of business and always at a low price

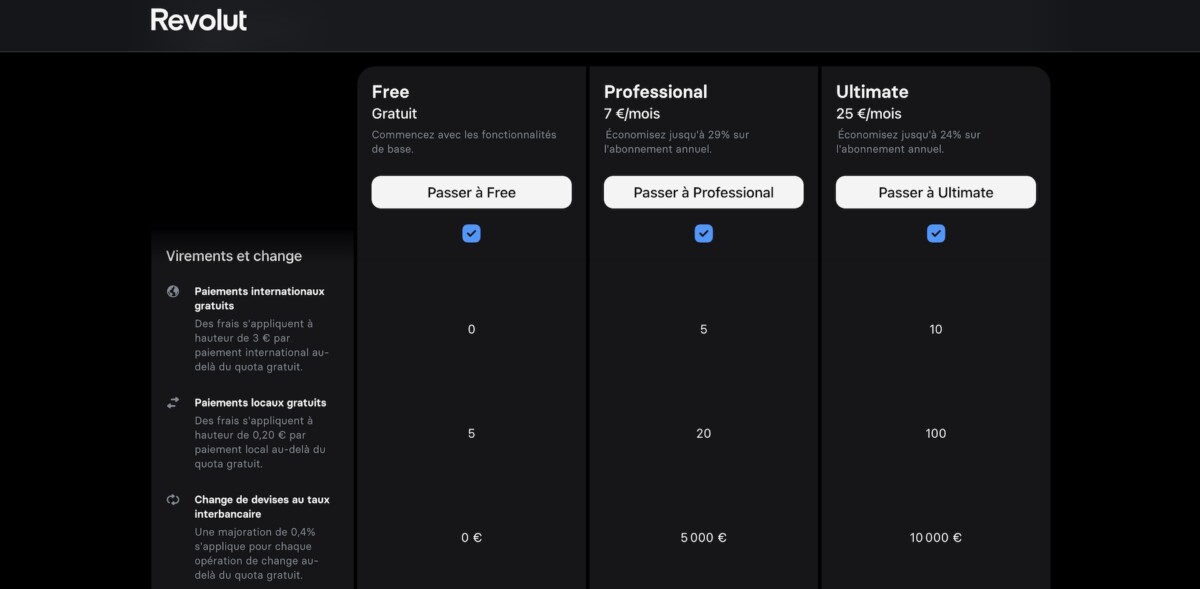

In the business segment, Revolut uses a principle that has largely proven itself among individuals: a free offer including the most standard banking services and paid plans whose price increases with the number of services included.

Even if the pack “Free” of Revolut Business is available to all companies, including the largest, it is primarily aimed at self-employed people and small structures with a service activity based exclusively in France. This free offer entitles you to:

- a Business card;

- up to 200 virtual cards to secure online purchases;

- free on 5 transfers in France and on all transfers sent to Revolut accounts, regardless of their country of domiciliation;

- no exchange fees on foreign currency payments (up to 150 currencies concerned);

- the possibility of receiving bank card payments from its own website and at competitive rates;

- balance and transaction tracking from the Revolut Business app.

This pack is very generous in base and also includes a metallic bank card with a premium look. But the advantage of paid plans lies above all in the number of free operations included.

Companies working abroad therefore have every interest in choosing one of the premium offers.

In terms of price, Revolut has planned particularly affordable plans for Freelancers. They thus have the choice between the plans “Free“, “Professional» at 7 euros per month, or “Ultimate» at 25 euros per month, which is much lower rates than those of traditional banks.

For larger structures, whose needs are higher, subscriptions range from 25 to 100 euros per month. Large companies can fully customize their options and are billed accordingly.

Advanced management tools to make everyday life easier

In addition to its advantageous pricing, Revolut stands out above all for the power and variety of tools made available to its Business customers. Thanks to its turnkey solution, daily management has never been so simple and quick to maintain.

In just a few clicks, all banking transactions are automatically synchronized with the company’s accounting software. There is therefore no need to systematically manually report each payment and each collection.

The interface of Revolut Business, available on the eponymous application for Android and iOS or from any browser, also offers in-depth tracking of all expenses. All those of the company are concerned, but also of each employee equipped with a personal bank card with individualized ceilings. Even expense reports can be issued directly from the application. Again, this saves additional time for the person responsible for accounting monitoring.

Finally, thanks to Revolut Business, managers and entrepreneurs no longer need to invest in invoicing software. The application allows bothissue invoicesto monitor the status of their payment and set up reminders to follow up with customers in the event of late payment.

So, not only does online banking allow you to save money by not having to purchase certain software, but it also gives you the keys to reducing the risk of non-payment as much as possible.

Varied collection methods to meet the needs of your customers

Despite its status as an online bank, Revolut offers businesses a multitude of options for getting paid. If the transfer remains the most common and most secure method of transaction for payments between professionals, once individuals are involved, this is no longer the case.

This is why Revolut offers its Business customers some alternatives, including:

- a credit card payment solution on their own merchant site;

- a tool for cashing bank cards remotely, during a telephone call for example;

- a payment terminal (TPE) compatible with all types of bank cards, but also with Apple Pay And Google Pay.

In all cases, whatever the solution chosen, the pricing is always advantageous and without hidden costs. For example, if you receive a customer payment of 100 euros via your website, Revolut only charges you 1.20 euros. And for the same amount collected directly in store via the TPE, the cost is even lower: 0.82 euros. The neobank therefore has no shortage of arguments for the pros.

Less than 10 minutes to request a Business account opening

Companies are also entitled to a simple and rapid procedure for open an account with Revolut. Two songs and that’s it!

Once on the site, simply complete a brief questionnaire in which you specify the address of the company, its type of activity, the banking features you plan to use and the desired plan. You may subsequently be asked for supporting documents.

As soon as the request is sent, Revolut takes care of verifying each element. And if the file is complete and compliant, the banking establishment will open the Business account.

[ad_2]

Source link